Episode #46: Financial Security for Your Special Needs Child

Show Notes: Feeling overwhelmed by the costs of managing your child’s disability? Do you ever worry about how your child might have enough savings when they’re older? You're not alone! The NC ABLE program is making it easier for people with disabilities to achieve financial independence. Learn how your child can benefit from this awesome opportunity during this episode of the podcast. Kristen Merrick of the NC State Treasurer’s Office took a few minutes to chat with us during the NC State Fair Access ABILITY Day event a few months ago, and I wanted to share with you what I was able to learn about the NC ABLE program. It looks like it might be a great option for children with disabilities even if they don’t live in NC! NC ABLE Website National ABLE Alliance Website IRS Webpage on ABLE programs Connect with Us: https://linktr.ee/waterprairie Support this channel: https://www.buymeacoffee.com/waterprairie Music Used: “LazyDay” by Audionautix is licensed under a Creative Commons Attribution 4.0 license. https://creativecommons.org/licenses/by/4.0/ Artist: http://audionautix.com/

The Water Prairie Chronicles Podcast airs new episodes every Friday at Noon EST!

Find the full directory at waterprairie.com/listen.

The NC ABLE Savings Program Explained

Show Notes:

Feeling overwhelmed by the costs of managing your child’s disability? Do you ever worry about how your child might have enough savings when they’re older? You’re not alone!

The NC ABLE program is making it easier for people with disabilities to achieve financial independence. Learn how your child can benefit from this awesome opportunity during this episode of the podcast. Kristen Merrick of the NC State Treasurer’s Office took a few minutes to chat with us during the NC State Fair Access ABILITY Day event a few months ago, and I wanted to share with you what I was able to learn about the NC ABLE program. It looks like it might be a great option for children with disabilities even if they don’t live in NC!

National ABLE Alliance Website

Connect with Us: https://linktr.ee/waterprairie

Support this channel: https://www.buymeacoffee.com/waterprairie

Music Used: “LazyDay” by Audionautix is licensed under a Creative Commons Attribution 4.0 license. https://creativecommons.org/licenses/by/4.0/ Artist: http://audionautix.com/

Financial Security for Your Special Needs Child:

The NC ABLE Savings Program Explained

Last fall, I had the opportunity to attend the North Carolina State Fair Access ABILITY Day event and speak with some of the families who attended with their children. I’ll post those interviews later this week, but today I wanted to share a resource with you that I found out about during my visit to the fair.

When we arrived at the area where they were having the main activities, the first person that we saw was Kristen Merrick with the North Carolina State Treasurer’s Office. Kristen was handing out information about the NC ABLE program and took some time to talk with me and tell me more about it. I was not familiar with the ABLE Accounts or the ABLE Program, and I was hoping that maybe we could provide this as a resource for others who may not be familiar with it either.

Kristen was telling me about the North Carolina program, but this program is available throughout the US so even if you’re not in North Carolina, you may find value.

I met Kristen as soon as I arrived at the Access ABILITY Day event, and I wanted to share with you what I learned about the ABLE Program. We started out by having Kristen tell us about the NC ABLE program.

We have the NC ABLE program that’s sponsored by the State Treasurer’s Office. This program helps people who are diagnosed with the disability before the age of 26. It helps so that if you are getting any type of federal government help or state help, you don’t have to worry about spending that money, that $2,000 that you’re restricted to, to have an asset.

Kristen went on to explain some of the benefits of the program, and this was where I was excited about the options families might not know about and why I decided to dedicate this episode to the ABLE Program.

Specifically, those different benefits, you don’t have to worry about losing those benefits. You can save up to $16,000 a year in this account and up to $250,000 for over a lifetime. This has helped people get cars. This has helped students go to college, people to buy homes, also for an inheritance, so all kinds of stuff.

And also any kind of interest that’s gained in there is tax free whenever it comes out.

The last question that I asked was actually a collection of situations that I posed to find out if the funds for the ABLE accounts could be used for those different situations.

So a specific question for some of our families that I’ve talked to, if they have a child who needs like transportation to school and they don’t have funding for that, is there a way for them to divert some of their savings to that?

Absolutely.

Would that be a benefit that they could have?

Absolutely. They can also use any of this money. The whole point is for them to be able to keep the money and then to use it for what we call qualifying spending expenses. So that literally can go anywhere. Even if you have a service dog, it can help with their vet bills, it can help with any type of transportation. If you have a cell phone, it can help with a cell phone. And lawn equipment, anything that helps you with your day-to-day activities.

So a respite care for a parent with a child who’s medically fragile, would that come into that category?

Yep.

So those are questions that I get a lot, and I’m not sure where to point them to.

Yeah. Yeah. And also they can have an authorized user that can help the disabled person who’s opening up this account, and they can help them manage the money as well.

Okay, good. Yeah. So it could be used for the future adult life for this child that they’re raising.

Absolutely.

Excellent.

Absolutely. But the biggest thing that I just recently heard is there was a girl who was going to grad school and with her NC ABLE account, she was able to save enough money where she was able to help pay her own way through school because she had this account with us. So it was just an awesome story to hear because that was the first time I had ever heard it used for that.

Excellent. Well, I appreciate you taking a few minutes to talk with us today and to pass this on to our listeners.

Absolutely. Thank you so much for your interest.

After hearing about the NC ABLE savings program from Kristen, I looked at the IRS website and the NC ABLE website to see what else I could find out about the program.

I’ll post the links to the websites in the notes for this episode, but here’s a summary of what I learned.

The Achieving a Better Life Experience Act of 2014 allowed states to offer what’s referred to as ABLE savings accounts according to the IRS. The ABLE Act of 2014 allows states to create tax advantage savings programs for eligible people with disabilities.

529A ABLE funds can be used to pay for qualified disability expenses and or tax free. The N C website states that able accounts have several benefits. Account holders are able to save and fund qualified disability expenses and still maintain their Medicaid, SSI, and other public supports. Starting in 2023, ABLE account owners can contribute up to $17,000 per year.

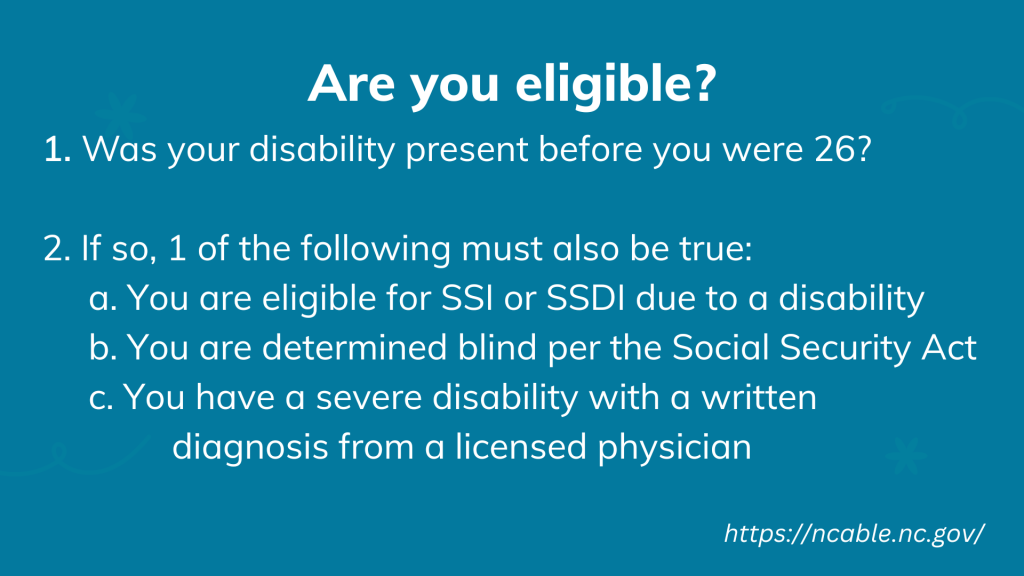

How do you know if your child is eligible? First ask yourself, was their disability present before they were 26 years old?

And if so, then one of the following must also be true.

1) They need to be eligible for SSI or SSDI due to a disability.

2) Or they need to have been determined blind per the Social Security Act.

3) Or they need to have a written diagnosis for a severe disability from a licensed physician.

Some other important things to know about the accounts. This comes from the NC ABLE website, balances less than a hundred thousand dollars are excluded from your SSI resource limit. If you exceed the SSI resource limit, then your SSI benefits will be suspended until the account balance no longer exceeds your resource limit, and you’ll continue to be eligible for Medicaid regardless of your account balance.

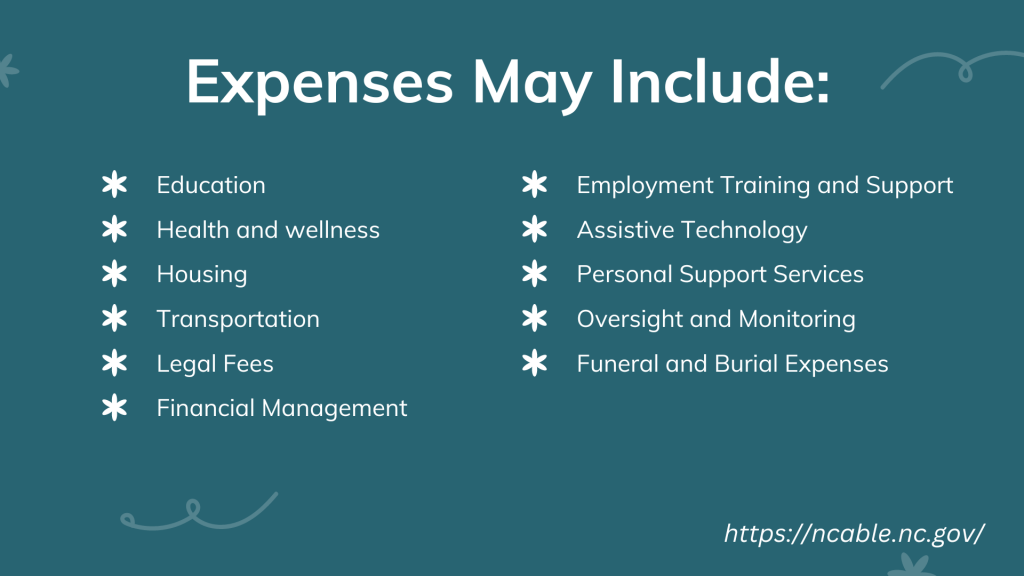

So I said earlier that qualified disability expenses could be paid for with these funds, but what are qualified expenses? They’re defined as any expenses that are the result of living with a disability and are intended to improve your quality of life. So some examples, because I know that’s always easy to understand a little bit better.

Some of these might include education, health and wellness, housing, transportation, legal fees, financial management, employment training, and support, assistive technology. Personal support services, oversight and monitoring and funeral and burial expenses. So it’s important to know what happens when funds are used for non-qualified expenses.

The earnings portion of the withdrawal is treated as income and taxed at your tax rate. It is also subject to a 10% federal tax penalty and applicable state taxes. Not all states offer ABLE accounts, but you can still take advantage of this type of savings by working with one of the states that do offer the accounts. To see which states offer the ABLE accounts and get connected, visit https://savewithable.com.